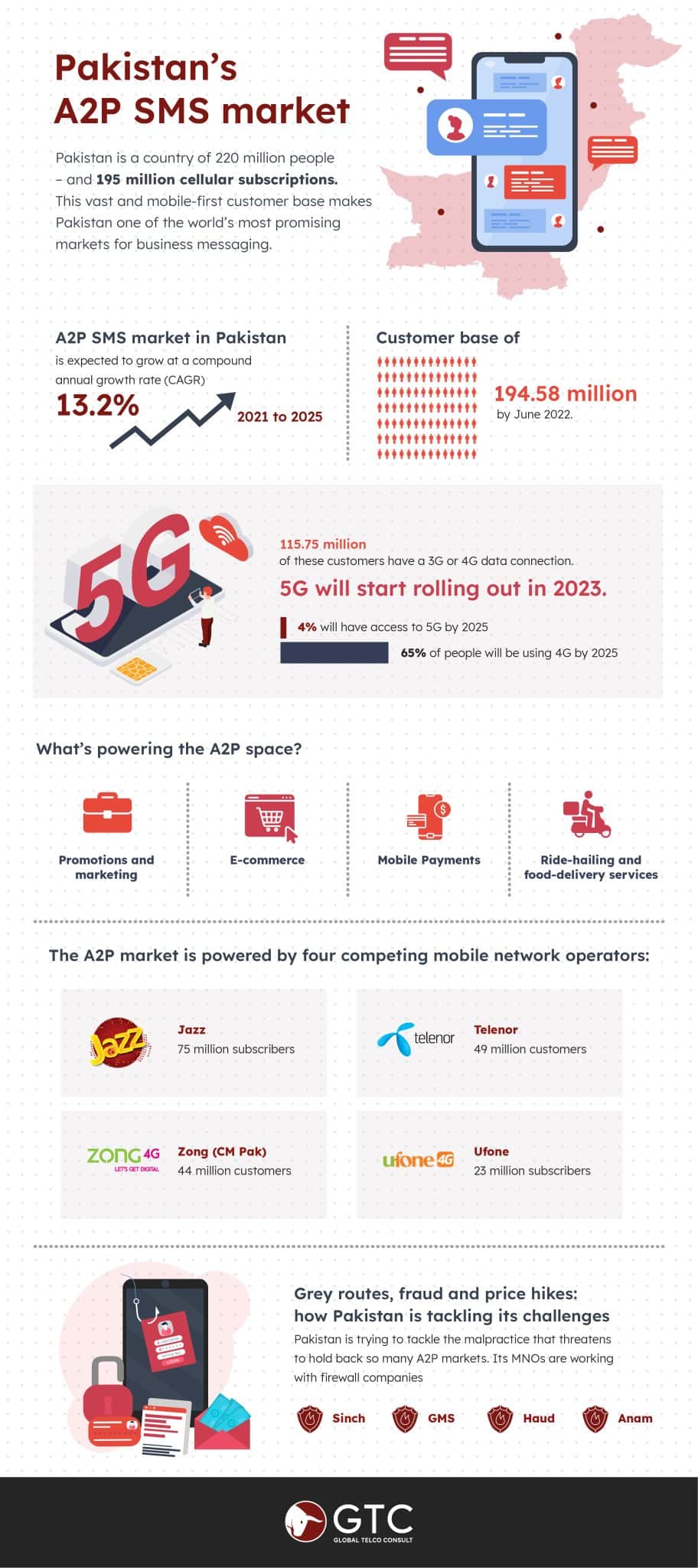

Pakistan is a country of 220 million people – and 195 million cellular subscriptions. This vast and mobile-first customer base makes Pakistan one of the world’s most promising markets for business messaging.

The last year has been tough for Pakistan. A combination of expensive energy imports and catastrophic flooding has put pressure on the country’s finances. In January, the government was forced to introduce emergency cost-saving measures.

But despite these difficulties, there is still optimism about the country’s long-term prospects. This is a nation of 220 million dynamic and entrepreneurial people. And like its neighbours India and Bangladesh, Pakistan is a mobile-first economy. Much of the energy in its economy is coming from the smartphone.

It is certainly home to a thriving A2P messaging sector. According to a report by Mobilesquared, the A2P SMS market in Pakistan is expected to grow at a compound annual growth rate (CAGR) of 13.2 percent from 2021 to 2025.

The Pakistani telco market: near-universal penetration

But first some general background. The start of Pakistan’s transition to a modern telco market came in July 2003 when the government introduced a Deregulation Policy for the Telecommunication Sector. This allowed overseas entrants to invest in the market.

Twenty years later, Pakistan has near-universal mobile penetration, with a customer base of 194.58 million by June 2022. What’s more, 115.75 million of these customers have a 3G or 4G data connection. 5G will start rolling out in 2023 – but slowly. The regulator expects just four percent of Pakistan’s population will have access to 5G by 2025, though 65 percent of people will be using 4G by then.

What’s powering the A2P space?

In terms of A2P messaging, the key drivers of the business come from four areas. They are:

Promotions and marketing

Businesses are using SMS to alert customers to offers and updates.

E-commerce

Online transactions are growing fast. E-commerce businesses use SMS to inform customers about orders, promotions and also for two-factor authentication.

Mobile Payments

Mobile wallet adoption is also a key factor. Millions of Pakistanis currently use apps such as EasyPaisa and JazzCash for payments, top-ups, passes and more. These wallets rely on SMS for notifications.

Ride-hailing and food-delivery services

Popular ride-hailing services in Pakistan include Uber, Careem, and InDriver, while popular food delivery services include foodpanda, Cheetay, and Jovi.

The A2P market is powered by four competing mobile network operators, each supported by a collection of aggregators and technical partners. They are as follows:

Jazz

Jazz has more than 75 million subscribers. It uses the pre-registered route feature and only allows alpha registration with Facebook, WhatsApp etc. The registration requires sender ID, user case and Company’s URL. Sinch is its exclusive partner for Jazz’s international A2P traffic.

Telenor

Telenor has 49 million customers. By default, A2P messages are delivered with shortcodes as sender IDs. So, if a user receives a message from Google or Facebook, the sender will display as not Google or Facebook, but as a short code. GMS is Telenor’s exclusive A2P partner.

Zong (CM Pak)

Zong has 44 million customers. It has a feature of Alpha, Alpha Numeric & dynamic and doesn’t allow numeric sender IDs. GMS, Acmetel and CMI are its preferred partners for A2P SMS.

Ufone

Ufone has more than 23 million subscribers. It has the same shortcode feature as Telenor (see above). GMS is its exclusive A2P partner.

Grey routes, fraud and price hikes: how Pakistan is tackling its challenges

For all its growth, Pakistan is trying to tackle the malpractice that threatens to hold back so many A2P markets. As such, its MNOs are working with firewall companies (Sinch, GMS, Haud and Anam) to combat phishing and grey routes.

The two bigger MNOs, Jazz and Telenor, are most exposed to fraudulent messaging activities, while Zong and Ufone are proving more resilient.

Pakistani aggregators and businesses are also wrestling with the price inflation that is now widespread in many markets, causing problems for some of the overseas brands that do business in the country.