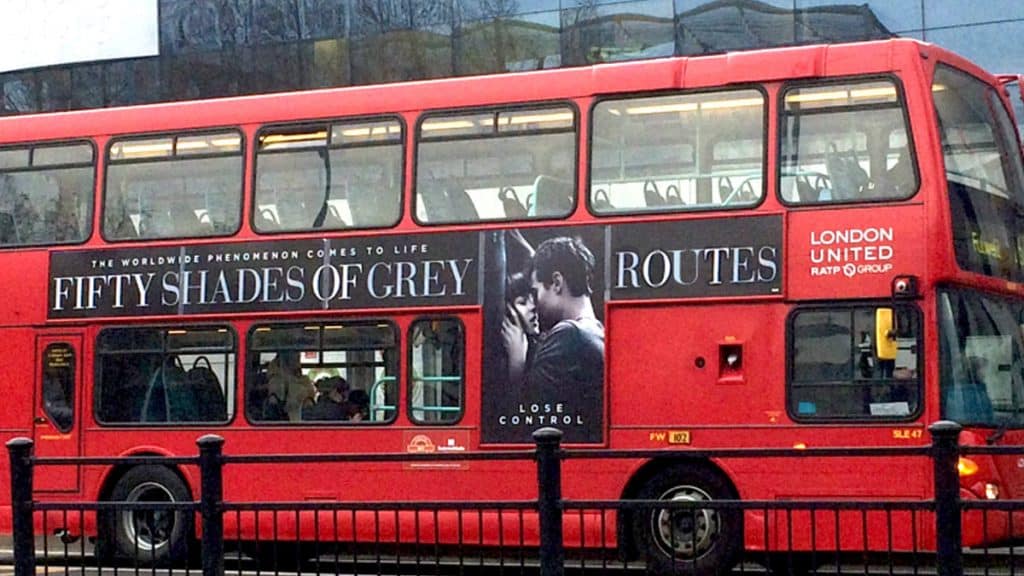

If Henry Ford were alive today, and working in the MNO messaging business he might be twisting his most famous alleged quote and telling his clients this:

“You can have any colour you want. Just make sure it’s not grey.”

Ford was an entrepreneur and an innovator. But most of all, he was a businessman whose goal was to make a profit. In the messaging business the use of ‘grey routes’ is a sure fire way for MNOs to lose money.

Why? Because a grey route is a cheat. While not illegal, grey routes give aggregators and enterprises a way to circumnavigate the proper route to an end user – and thereby cut costs.

But this is a false economy. Ultimately grey routes hurt enterprise customers. Grey route messages look cheap at first sight. But they are unpredictable. They don’t always arrive unmodified at their intended destination. When notifying a customer of a business critical process, this can have serious consequences.

In the long run everybody – enterprise, MNO, aggregator, end user – loses.

The financial cost of grey routes? $7.69 billion a year.

Before we get into the details of what a grey route is, here’s some evidence of how the widespread use of grey routes harms the market for A2P messaging.

The industry analyst Mobilesquared estimates that the total value of A2P SMS in 2024 could be $27.48 billion by 2024 if all traffic is ‘white’.

Sadly, Mobilesquared doesn’t think it will be. Instead, it believes just under a quarter of the projected 2 trillion A2P SMSs sent will be grey.

As a result, it calculates that these grey messages will leak $7.69 billion a year away from MNOs.

Pretty alarming right? So what’s to be done? Well, first let’s explore exactly what a grey route is. To do that, we need to look at the basics of how text messages are routed from sender to recipient.

Routing an SMS: the basics

Let’s start with the simple example of a P2P message session between two friends: Adam and Eva.

In the most straightforward scenario, both are on the same mobile network. This is called ‘on-net’, so the friends’ MNO handles the message internally. It can do so without any additional costs except internal network expenses.

But what if Adam and Eva are on different networks? In other words, the message goes ‘off-net’ (when in the same country) or goes ‘international’?

Well, this is made easier by so-called ‘interworking agreements’. These schemes ensure that MNOs are technically connected, and have a commercial arrangement to pay each other a fee for delivering SMSs to each other’s subscribers.

In this case, Adam’s operator A-Telecom pays Eva’s operator E-Telecom for terminating the message. Of course, A-Telecom still charges Adam for sending the message (either on a per message basis or as part of his bundle).

And when Eva replies to Adam? The same fees apply in the other direction.

Roaming without interworking – one key ingredient for grey routes

So far so good, interworking agreements make all this activity a zero sum game for the operators because the volume of P2P traffic is usually equal on both sides. And every operator reaps the benefits of charging its own SMS sending subscribers. This is the wonderful and stable world of P2P.

OK, so let’s move on to the next level of complexity.

Now, Adam has travelled to the exotic island of Lilliput. Since Lilliput is small and underpopulated, it only has one MNO: LilliComm. Not much traffic moves between LilliComm and A-Telecom, so there is no interworking agreement for SMS between the two operators.

This is logical: the overhead of managing such a billing scheme would be more expensive to LilliComm and A-Telecom than the cost of exchanging a handful of messages each month.

The absence of an interworking agreement doesn’t stop Adam from using his phone on holiday though. A-Telecom and LilliComm have a roaming connection. This means that traffic can flow between the two operators – but without any cost in either direction.

Are you keeping up?

Hope so, because now we are ready to see how ‘clever’ aggregators can exploit the above conditions to create grey routes.

A2P messaging and the grey route workaround

OK, let’s add an SMS aggregator into the mix: BusinessTel. Every month BusinessTel sends a lot of A2P SMS traffic to end users at A-Telecom. To do this, it signed an agreement with A-Telecom, and pays the per-message fees. We call this an official or ‘white’ route.

But then BusinessTel has a crafty idea. It decides to send its texts to A-Telecom via LiliComm. It knows that there is no interworking agreement in place, so it cooperates with LiliComm to send what are in effect free messages and paying LiliComm a fraction of what it would pay if it went direct with A-Telecom.

BusinessTel passes on some of the savings to its enterprise customers, who are delighted with the low A2P prices.

As we’ve said, this grey route activity is not illegal. But it is corrosive.

Here’s why. After a while A-Telecom notices the unusual messaging traffic from LiliComm. They know something is up, and they either use firewalls to block the traffic or set up a proper interworking agreement.

Needless to say, at this point BusinessTel can move on to another small overseas MNO without an interworking agreement. But in the process many message campaigns will be disrupted.

Meanwhile the time gap between setting up a grey route and being detected is shrinking.

A few years ago savvier aggregators kept their traffic numbers low enough to stay under the radar. Today, this doesn’t work so well. Most networks have developed monitoring and filtering capabilities that help them detect a grey route in days or even hours.

The urge to go grey gets darker

Regrettably, better detection hasn’t stopped the more unscrupulous companies in the business. In fact, they have moved into even darker areas of activity. More black than grey.

One is GT spoofing. GT means Global Title, which is the codename that MNOs use to identify themselves to each other. It’s possible for SS7-savvy aggregators to fake an MNO’s GT to cloak its traffic as coming from the spoofed MNO – leading to the MNO getting the invoice.

Another example is SIM card farms. Here, the aggregator buys SIM cards intended for personal use. These cards often offer unlimited flat rate messaging, so the companies buy them in bulk, put them into a modem and crank out text messages 24/7.

MNOs try to stop this activity by monitoring these cards to see if they indicate personal use. But even then, the unscrupulous aggregators try to stay a step ahead. They rotate the numbers or even put the SIM card farms on a truck so they keep moving as if they belong to personal smartphones.

It is a true cat and mouse game. Ultimately it is also a losing game.

As the saying goes, you get what you pay for. If you find very low prices on the SMS A2P market, there is a high likelihood that your messages will use one of the grey routes described above.

And if they are, you might find important messages going undelivered without warning.

We’re here to help

At GTC, we have a good view of the extent of grey market activity, the damage it can do and the most effective ways to combat the problem. We help MNOs find the leakage through our Network Penetration Tests and we support enterprises with their SMS procurement, just to mention two concrete examples from our service portfolio.

Please get in touch.

Global Telco Consult (GTC) is a trusted independent business messaging consultancy with deep domain knowledge in application-to-person (A2P) services. GTC provides tailor-made messaging strategies to enterprises, messaging service providers, operators and voice carriers. We have expertise in multiple messaging channels such as RCS, Viber, WhatsApp, Telegram and SMS for the wholesale and retail industry.

GTC supports its customers from market strategy through service launch, running the operations and supporting sales and procurement. The company started in 2016 with a mission to guide operators and telcos to embrace new and exciting opportunities and make the most out of business messaging. For more information or industry insights, browse through our blog page or follow us on LinkedIn.